We are Virtú.

Focused Expertise

Challenging Assumptions

With over two decades of investing/operating large-format rental housing, our deep experience in all aspects of value creation gives us the diversity of perspectives to see what others may not.

Product/Market Focused

Virtú creates value through research, thoughtful renovations and operational creativity, We target markets with favorable supply/demand dynamics setting-up for sustained growth.

Continuous Improvement

We believe in continuous improvement. The mindset drives all aspects of our investment methodology from the innovative structure of our funds to the holistic approach we bring to modernizing the rental experience.

Built for the Long-term

Virtú is designed to run for decades with the highest GP/LP alignment.

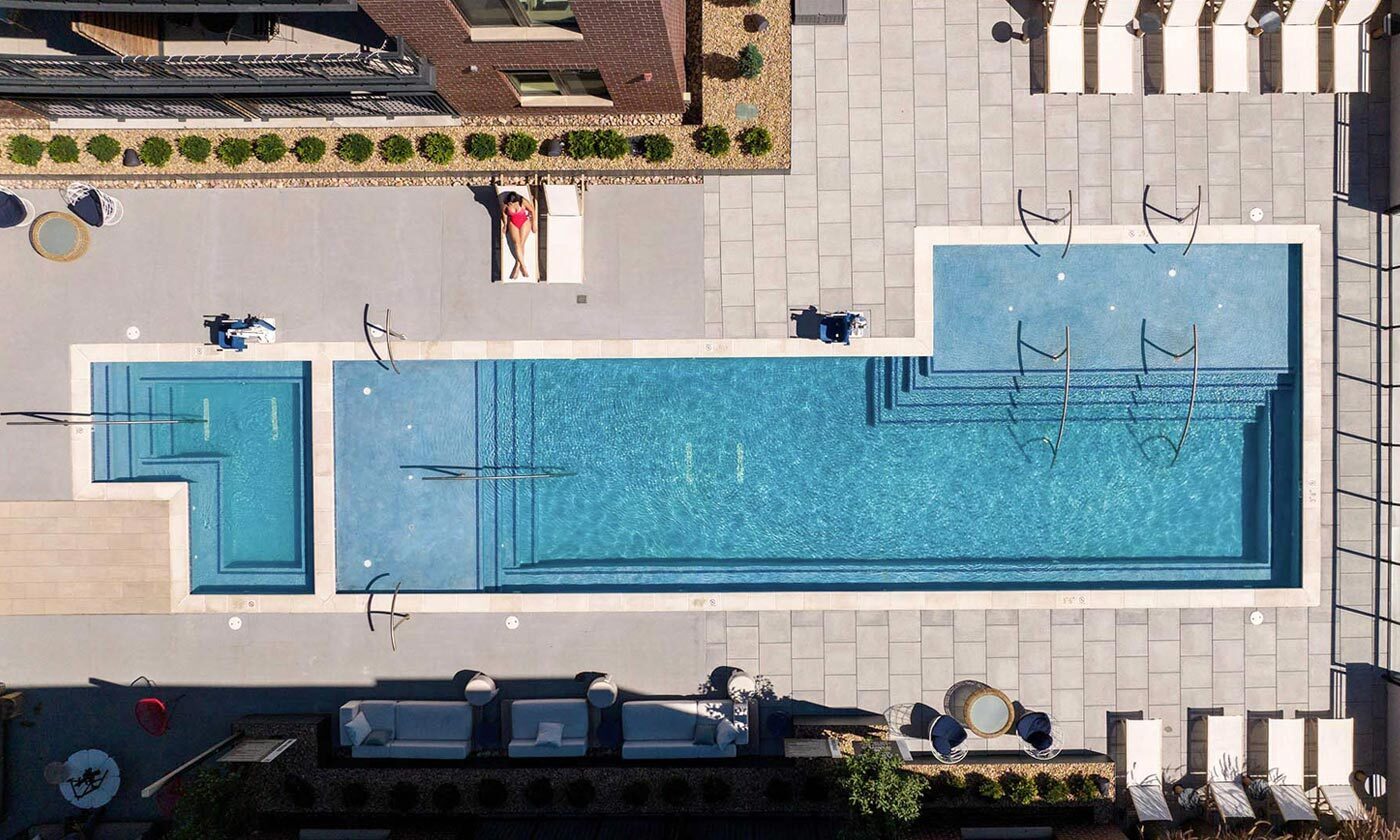

Valuing Community

We make well-being and personal connection a key part of our business plan for every property.